A need for hybrid and multicloud strategies for financial services

The financial services industry is a dynamic space that is constantly testing and pushing novel use cases of information technology. Many of its members must balance immense demands—from the pressures to unlock continuous innovation in a landscape with cloud-native entrants, to responding to unexpected surges in demand and extend services to new regions—all while managing risk and combatting financial crime.

At the same time, financial regulations are also constantly evolving. In the face of the current pandemic, we have seen our customers accelerate in their adoption of new technologies, including public cloud services, to keep up with evolving regulations and industry demands. Hand in hand with growing cloud adoption, we’ve also seen growing regulatory concerns over concentration risk (check out our recent whitepaper on this), which have resulted in new recommendations for customers to increase their overall operational resiliency, address vendor lock-in risks and require effective exit plans.

Further complicating matters, many financial services firms oversee portfolios of services that include legacy apps that have been in use for many years. These apps often cannot support the implementation newer capabilities that can accommodate mobile application support, business intelligence, and other new service capabilities, and suffer from shortcomings that adversely affect their resiliency, such as having outdated and manual processes for governance, updates, and security processes. These legacy applications also have high vendor lock-in because they lack modern interoperability and portability. Furthermore, the blunt force approach of leveraging legacy technology as a means for protecting against financial crime is an unsustainable strategy with diminishing returns—with big banks spending over $1 billion per year maintaining legacy infrastructure and seeing a rise in false positive rates as financial crime evolves in sophistication.

As a means to address the demands of modernization, competition, and compliance, financial services organizations have turned to public cloud, hybrid cloud and multi-cloud strategies. A hybrid model enables existing applications—which originally exist on-premises—to be extended by connecting to the public cloud. This infrastructure framework unleashes the benefits of the public cloud—such as scale, speed, and elastic compute, without requiring organizations to rearchitect entire applications. This approach provides organizations the flexibility to decide what parts of an application should reside in an existing datacenter versus in the public cloud, as such providing them with a consistent and flexible approach to developing a modernization strategy.

Additional benefits of successful hybrid cloud strategies include:

◉ A unified, consistent approach for infrastructure management: Consistently manage, secure and govern IT resources across on-premises, multicloud and the edge, delivering a consistent experience across locations.

◉ Extending geographic reach and openings new markets: Meet the growing global demand and extend into new markets by extending the capabilities of datacenters to new locations – while also meeting data localization requirements from local markets

◉ Managing security and increasing regulatory compliance: Hybrid and multicloud are great alternatives for strictly on-premises strategies due to cloud benefits around service security, availability, resiliency, data protection and data portability. These strategies are often referenced as a preferred way of reducing risk and addressing regulatory compliance challenges.

◉ Increasing Elasticity: Customers can respond with agility to surges in demand or transaction by provisioning and de-provisioning capacity as needed. A hybrid strategy allows organizations to seamlessly scale their capacity beyond their datacenter during high-compute scenarios, such as risk computations and complex risk modeling, without over exhausting servers or slowing down customer interactions.

◉ Reducing CapEx Expenses: The cloud makes the need for such a large capital outlay for managing on-premises infrastructure unnecessary. Through the benefits of elastic capacity in hybrid scenarios, companies can avoid the costs of unused digital capacity, paying only for the resources that are consumed.

◉ Accelerate time to market: A hybrid strategy provides a bridge that connects on-premises data to new cloud-based capabilities across AI and advanced analytics, allowing customers to modernize their services and unlock innovation. With virtualized environments, they can accelerate testing and evaluations cycles and enable deployment seamlessly across different locations.

A multicloud strategy enables customers to leverage services that span different cloud platforms, enabling them to select the services best suited to the workloads or apps they are managing.

Commonly cited benefits of a multicloud strategy include:

◉ Flexibility: Customers wish to have the flexibility to optimize their architectures leveraging the cloud services best suited to their specific needs, including the flexibility to select services based on features or costs

◉ Avoiding vendor lock-in: A common requirement customers often state, customers often seek design multi-cloud deployments to achieve short term flexibility and long-term agility by designing systems across multiple clouds.

Microsoft hybrid and multicloud edge for financial services organizations

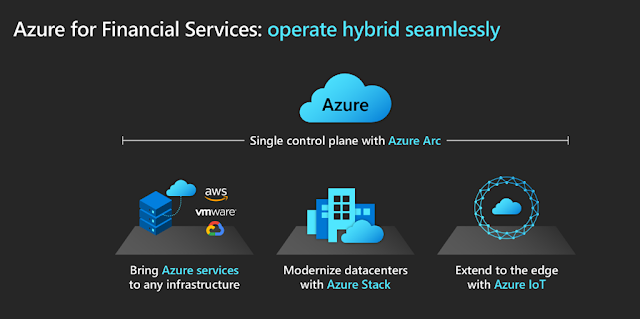

Azure hybrid capabilities uniquely address some of the main barriers customers face around hybrid and multicloud strategies. Managing multiple environments is an endeavor that introduces inherent complexity and risk for firms, faced with an expanding data estate that spans diverse on-premises, public cloud(s), and edge environments. Optimizing for productivity without sacrificing security and compliance can be daunting. Azure provides a seamless environment for developing, deploying and managing data and applications across all distributed locations.

For one, Azure uniquely supports the full range of hybrid capabilities across DevOps, Identity, Security, Management, and Data. Given that customer IT estates involve much more than containers, many of our cloud benefits are also available to server-based workloads. Azure enables customers to manage both Windows and Linux servers across their data estate and customers can also manage access and user authentication with hybrid identity services. The Azure Stack portfolio extends Azure services and capabilities to your environment of choice—from the datacenter to edge locations and remote offices and disconnected environments. Customers can run machine learning models on the edge, in order to get quick results before data is sent to the cloud. Furthermore, with capabilities such a Azure Stack Hub, our portfolio enables organizations to operate in offline environments that block data from being sent to the public cloud, especially if required for regulatory compliance.

Second, Azure simplifies the experience of managing a complex data estate by providing a unified, consistent approach for managing and monitoring their hybrid or multicloud environments. With capabilities such as Azure Arc, can manage their data estate with a single management plane—including the capability to monitor non-Microsoft clouds. Customers can also take a similarly simplified approach to managing security across their estate with services such as Azure Sentinel, which provides a consistent threat detection and security analytics view across on-premises, cloud and edge devices. In combination with services such as Azure Security Center, Azure policy, and Azure advisor, customers can also design, deploy, and oversee security and compliance of their deployments across their hybrid and multicloud environments.

Azure leadership in hybrid and multicloud offerings is also rooted in our extensive collaborations with hardware partners (OEMs), which whom we have partnered and co-engineered solutions to deliver a well-defined variety of supporting devices. Partner solutions have been designed with the aim in mind to increase resiliency and expand the reach of virtual data centers. With the new rugged series of Azure Stack Edge for instance, we provide cloud capabilities in the harshest environment conditions supporting scenarios such as tactical edge, humanitarian and emergency response efforts.

The Azure commitment to financial services customers stems from Microsoft industry-leading work with regulators around the world. Our customers require their cloud partners to support transparency, regulatory right to audit, and self-reporting. To enable this, we have a dedicated and comprehensive FSI compliance program available to customers and help customers manage their compliance by enabling choices around data location, transparency and notification of subcontractors, providing commitments on exit planning (see our recent blog here), as well as tools to aid in risk assessments.

0 comments:

Post a Comment