Managing cloud costs can be challenging; especially if your organization needs to break down costs for internal chargeback. You might have separate business units, or you might need to facilitate external billing for distinct customer solutions. This becomes even more difficult when you employ shared services to reduce costs, since there may not be a clear way to break those shared services down by business unit or customer. This is where Azure Cost Management + Billing’s cost allocation preview for Enterprise Agreement (EA) and Microsoft Customer Agreement (MCA) accounts comes in.

Cost allocation is how you break down and distribute costs throughout the organization. Cost allocation is usually performed by identifying the shared services being used, pinpointing which business units or projects are utilizing those services, and determining how costs should be split across each.

Here are a few real-world situations you may be seeing today:

◉ Networking — Multiple virtual machines (VMs) are using the same network infrastructure. Currently central IT covers these network costs as overhead, but there’s a desire to reduce that overhead and allocate those costs back to the departments or applications using them, driving more accountability of the full costs they’re incurring with their respective solutions. With cost allocation you can distribute the costs back to the departments or applications.

◉ Database and storage accounts — Over time, separate teams created different database servers or storage accounts for separate (and sometimes related) needs. In an effort to optimize costs, these were consolidated to a single server or account. Now, since usage is tracked and billed at a server or account level, you don’t have the same attribution by application. With cost allocation you can assign costs to each department, application, or end customer for the data they’re storing.

◉ Inconsistent reporting — Managing costs for shared services isn’t a new problem. Some organizations built internal solutions or worked with partners to accomplish the goal. While this gives you the distribution of costs, you may see complaints about costs reported in the Azure portal not matching those within internal reports, which account for external cost allocation rules. This inconsistency can lead to unexpected costs within each team, additional internal support costs by central IT, and general frustration across the board. With cost allocation, everyone can have full transparency for the costs they’re responsible for, regardless of whether they’re incurred directly or indirectly.

Do any of these circumstances sound familiar? If so, look at how cost allocation can help you achieve your financial operations (FinOps) goals without the stress.

Getting started with cost allocation is an easy process:

Identify your shared costs — The first step in creating your cost allocation rule is to identify which shared costs you want to split. In the cost allocation preview, you can identify these costs by subscription, resource group, or tag. For example, this may be the resource group or subscription where your network infrastructure is hosted. Or perhaps you tagged shared costs, in which case you can select the applicable tags.

Specify where to move costs — Next, specify where you want those shared costs to be moved. Similar to identifying the shared costs, you can choose to move costs by subscription, resource group, or tag. This will create additional records within your usage data to represent the portion of the shared costs, but with the new subscription ID or resource group name. When you opt to move costs to one or more tags, you’ll see one new row for each tag, where all attributes are the same, except for the new tag that’s added.

Determine the split — Lastly, indicate how you want to distribute the costs. In the cost allocation preview, you can choose to distribute with the following ways:

◉ Distribute evenly (e.g. 10 percent across 10 targets).

◉ Proportional to total cost (e.g. if a target is 25 percent of total cost of all targets, it will get 25 percent of the shared costs).

◉ Proportional to either compute, network, or storage cost.

◉ Custom distribution by percentage.

Know when cost allocation is right for your organization

Cost allocation is how you break down and distribute costs throughout the organization. Cost allocation is usually performed by identifying the shared services being used, pinpointing which business units or projects are utilizing those services, and determining how costs should be split across each.

Here are a few real-world situations you may be seeing today:

◉ Networking — Multiple virtual machines (VMs) are using the same network infrastructure. Currently central IT covers these network costs as overhead, but there’s a desire to reduce that overhead and allocate those costs back to the departments or applications using them, driving more accountability of the full costs they’re incurring with their respective solutions. With cost allocation you can distribute the costs back to the departments or applications.

◉ Database and storage accounts — Over time, separate teams created different database servers or storage accounts for separate (and sometimes related) needs. In an effort to optimize costs, these were consolidated to a single server or account. Now, since usage is tracked and billed at a server or account level, you don’t have the same attribution by application. With cost allocation you can assign costs to each department, application, or end customer for the data they’re storing.

◉ Inconsistent reporting — Managing costs for shared services isn’t a new problem. Some organizations built internal solutions or worked with partners to accomplish the goal. While this gives you the distribution of costs, you may see complaints about costs reported in the Azure portal not matching those within internal reports, which account for external cost allocation rules. This inconsistency can lead to unexpected costs within each team, additional internal support costs by central IT, and general frustration across the board. With cost allocation, everyone can have full transparency for the costs they’re responsible for, regardless of whether they’re incurred directly or indirectly.

Do any of these circumstances sound familiar? If so, look at how cost allocation can help you achieve your financial operations (FinOps) goals without the stress.

Streamline financial reporting with cost allocation

Getting started with cost allocation is an easy process:

Identify your shared costs — The first step in creating your cost allocation rule is to identify which shared costs you want to split. In the cost allocation preview, you can identify these costs by subscription, resource group, or tag. For example, this may be the resource group or subscription where your network infrastructure is hosted. Or perhaps you tagged shared costs, in which case you can select the applicable tags.

Specify where to move costs — Next, specify where you want those shared costs to be moved. Similar to identifying the shared costs, you can choose to move costs by subscription, resource group, or tag. This will create additional records within your usage data to represent the portion of the shared costs, but with the new subscription ID or resource group name. When you opt to move costs to one or more tags, you’ll see one new row for each tag, where all attributes are the same, except for the new tag that’s added.

Determine the split — Lastly, indicate how you want to distribute the costs. In the cost allocation preview, you can choose to distribute with the following ways:

◉ Distribute evenly (e.g. 10 percent across 10 targets).

◉ Proportional to total cost (e.g. if a target is 25 percent of total cost of all targets, it will get 25 percent of the shared costs).

◉ Proportional to either compute, network, or storage cost.

◉ Custom distribution by percentage.

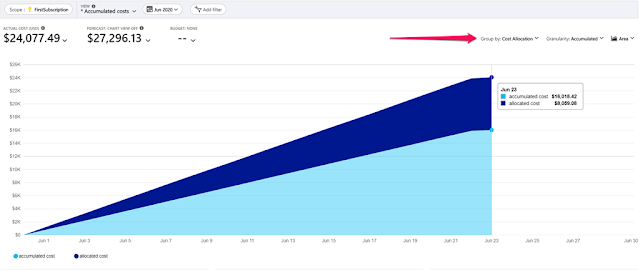

Once your cost allocation rule has been defined and cost data has been processed, anyone using the Azure portal will see cost based on your new cost allocation rules. This means the source subscriptions, resource groups, or tags will have no cost and the target subscriptions, resource groups, or tags will see additional cost based on the distribution rules. You can see the impact of your cost allocation rules in cost analysis by selecting Cost allocation from the Group by drop-down.

Keep in mind that cost allocation does not affect your Azure invoice. Costs cannot be move out of or into a billing account. Cost allocation is simply moving costs around within your billing account to facilitate organizational reporting and chargeback. Billing responsibilities are not changed.

0 comments:

Post a Comment